Do you know what trigger price means? The most commonly used phrase in the stock market confuses most people, and “trigger price” is also one. If you are also one of those persons who get confused with this phrase, don’t worry. In this blog, I will explain it in more detail and cover the essential information you need to know if you want to stay in the stock market. So, let’s start discussing trigger price meaning and its other essential components.

What is a Stop Loss Order?

Before we start understanding, it is better to understand stop loss first because it will help you understand trigger price.

The stop-loss order is the order for the future to sell securities when they hit some fixed price level. This method limits the risk involved in the trading and can be used for long-term and short-term securities to sell or invest in.

Here an individual can automate the process with the help of their financial advisor and give them a small brokerage commission fee. The stop order is also considered or called the stop order or stop market order. When the individual fixed their price level in their stop-loss order, the agent gets the instruction to sell that security to the buyer when it crosses the fixed price level.

Example of Stop Loss Order

If trader or investor x wants to buy the stocks of XYZ company at the desired price, he can fix the desired price or inform his agent to put the limit. So that whenever the price particular stock surpasses the fixed cost, the stock is immediately placed.

Similarly, if investor or trader A of XYZ company can sell his stock by fixing stop-loss price. And when the share price goes similar or higher, then automatically, stock sold out. This process immediately happens, and the trader does not need to keep watching the trends.

Why Stop Loss Order is Important

It is an effective technique that a trader can use to schedule short-term investments to sell at the desired cost.

Stop-loss is also a valuable instrument for investors who do not want to spend a whole day seeing the track of stock or securities.

The action is performed immediately; therefore, it can reduce some limitations.

If you are a small trader or willing to have a secured deal, this technique can work for you.

Also Read: Upper Circuit Meaning & How it Works in Share Market?

What is Trigger Price Meaning?

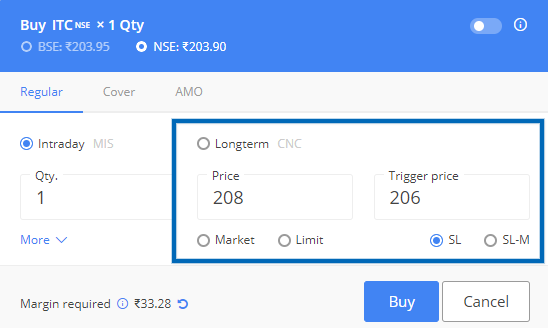

Trigger price is included or part of stop-loss trading. You can enter two types of prices here while making your stop-loss order, i.e., trigger price and the limit price. When the price level of the securities reaches the trigger price. Then the stop market order gets triggered, and your order is complete when it matches the limit price you set.

Therefore the value where your future order to buy or sell the securities activated on the exchange platform is called trigger price. In other words, the trigger price is the price set by the trader at which stock exchange platforms like NSE and BSE activate an order to buy or sell securities.

Pros and Cons of Using Trigger Price

Trigger price is helpful for many of the traders as they can automate the buying and selling process of securities. This process should be done because they can forget the position they set some days ago, and this can cause a loss.

The traders should revisit and open trade triggers many times a day because they can track the performance. You can use day-long orders and check the performance at the end of each day. Trade triggers can place the compound orders, but this process should be done if the trader is entirely sure about its relevance.

Example of Trade Trigger

If you want to buy 60 stocks of 100 each using the stop loss order technique. Then first, you will place a stop-loss order so that you can limit the risk involved. Here you will have to set a limit and trigger price. In the limit price, you can set Rs 80 and trigger value 90.

Once you are done with this crucial step, the platform you are using will sell or buy the securities as soon as it reachers to trigger value (Rs 90) or falls under it. So, when the securities’ price crosses Rs 80, then the order will automatically get placed.

Conclusion

Stop-loss orders help in selling or buying the stocks are desired price using trigger price and limit price. It automates the process once the price of securities crosses the trigger price. If you are in the new trading world, this can be a valuable instrument because you can set the price, target price, and stop-loss here.

These days having information about trigger price and other similar concepts are significant. This helps in avoiding any uncertain loss and maximize earning potentials. If you want to keep reading such kinds of fantastic stock market-related concepts and essential information. Then keep reading our other blogs, and do not forget to share this valuable information with your friends.