Margin in the stock market means an activity by which the trader or investor buys the stocks or securities in large quantities even if they can’t afford such big trades. In the Indian stock market, margin trading is also called intraday trading, and many stock broker platforms provide this facility.

It basically involves buying and selling listed securities, mostly stocks, in a session. Investors must make an accurate guess based on the latest stock market trends and up and down to execute their margin trade. With the growth of technology and e-stock broker platforms, executing margin intraday has become accessible.

What is Margin in Trading?

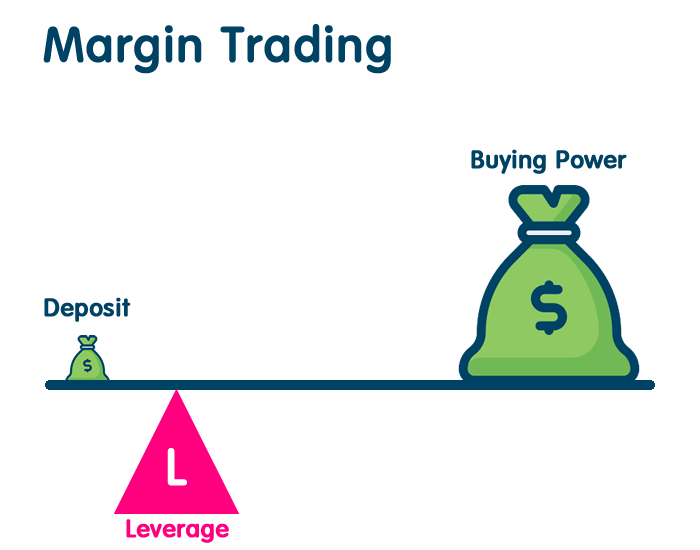

Margin or margin trading in the stock market refers to the process of borrowing funds from the stock broker to buy a certain volume of stocks in one session. With borrowed funds, investors are allowed to buy various listed securities. Many stock brokers provide this feature to help their investors to enjoy a larger position and boost their gains from stock trading.

However, to involve in margin trades requires opening an MTF or Margin Trading Facility account with the selected broker and maintaining the required minimum fund in the account, which is also called margin. Before executing margin trading, investors need to self-fund a certain percentage of trade value, and the stockbroker funds the remaining balance.

In exchange, a stock broker charges a fixed percentage of interest fee from investors on the borrowed fund.

SEBI’s Regulation on Margin in Stock Trading

Earlier, margin trading in India was only permitted in cash mode, where shares were restricted to provide as collateral. But after SEBI’s new regulation on margin trading in 2018, investors can execute margin trading by keeping owned shares as securities.

But only registered stock brokers can provide margin account facilities to regular traders and investors.

Margin Trading Example

Let’s understand margin in trading with an example.

Assume Mr. A bought one of the listed stock’s lots for Rs 80,000, and when squaring off, the lot stock prices in the stock market increased by Rs 90,000, and Mr. A has already paid for it in full. With this transaction, he would earn an intraday gain of 12.5%, which is Rs 10,000. But if he uses the margin trading facility provided by his stockbroker where Mr. A keeps Rs 30,000 as the margin, the rest is funded by the stockbroker. In that case, Mr. A will earn 75% ROI, which is Rs 60,000.

Advantages of Margin

Below are some advantages of margin trading; let’s discuss them.

1. Help to Make Short-Term Gains

Margin trading helps investors to make short-term gains from the price fluctuation of selected stocks during intraday trading. To execute margin trade, investors do not need to have enough funds to execute large-volume trading, as they can borrow some funds using their MTF account and use them for further trading.

2. Leverage Their Position

This trading type helps investors to buy a large volume of stocks by putting a small number of funds on their side. And they can enjoy a favorable position to benefit from price fluctuations during the trade. Although, the investor must carefully use margin trading as it can cause significant loss if not utilized properly.

3. Making Use of Unused Securities

Margin trading helps investors use their existing securities in a Demat account to put on collateral and make some large volume trade to increase their short-term earnings.

4. Allowed by SEBI

As we discussed above, margin trading in the Indian stock market is allowed by SEBI, and it is regulated under its predefined regulations.

Risks of Margin

There are certain risks involved with margin trading, such as those mentioned below.

1. High-Risk Level

Margin trading can allow investors to earn more return intraday, but it can also cause significant losses if the trade fails to perform well. For example, if the stock price decreases when squaring off, in that case, the stock trader will face a loss and will also have to pay interest on borrowed money.

2. Have to Maintain Margin

In the investor’s Margin Trading Facility account, the investor needs to maintain the minimum balance requirement that keeps a certain amount of capital locked in condition. If the investor fails to maintain the margin amount, the stockbroker will ask them to maintain it or sell the required number of securities to maintain minimum balance requirements.

3. Liquidation Risk

The stock broker has the right to liquidate the collateral securities, such as stock if an investor fails to uphold the used or borrowed amount due to loss or other reasons. However, if investors follow the right strategy when margin trading and use margin trading funds carefully, there can be a minimum risk of any liquidation loss.

How Margin Trading Works?

Let’s also understand how margin works in the stock market.

When you open your MTF account with an authorized stock broker, maintain the account’s margin amount. In that case, you get 4-5 times extra fund facility from the stockbroker, which you can use to execute large volume trades intraday using margin trading.

Before executing your trade, you will have to update your stockbroker, keep some portion of the trade value, and ask for an additional amount that your broker can provide you for further trading activity.

If you use this borrowed fund to execute margin trade, you can significantly boost your trade gains. In exchange, you pay a small interest charge along with the borrowed fund.

Tips for Margin Trading

Below are some tips when using margin trade in the stock market.

- When you use a broker’s fund, invest wisely, as you will have to return the borrowed amount or your broker will liquidate your collateral securities in the market to uphold the losses.

- You should try to utilize less than the given limit provided by the broker and see how it’s going. Once you get confident, you can also try the upper limit to maximize your profits.

- The margin facility provided by a broker is a type of loan, and you will be required to pay interest on the used amount, which will affect your existing portfolio.

Conclusion

The margin trade is one such way available in the stock market to boost intraday profitability. If you make wise use of that cost-effective facility, it can be one of the ideal ways to increase your wealth by trading in the stock market. However, it’s crucial to remember it can cause significant loss if not utilized well.